If filed under 7th proviso to section 139(1) If filed in response to notice u/s 139(9)/142(1)/ 148 enter the date of such noticeĬhoose the category of your employer from the drop down menu So, if you have received any notice under section 139(9)/142(1)/148/, and filing your ITR in response to these, then enter the Unique No./Document Identification Number (DIN) and Date of such notice or Order in DD/MM/YYYY format. Many times, we receive notice from the IT department even when we have filed ITR. If you are filing the revised return under section 139(5) or defective return u/s 139(9) is asked by the department, then write the Acknowledgement number and date of filing the original return in DD/MM/YYYY format. Select the appropriate section applicable on your tax situation.įile through Tax2win and avoid the hassle of finding the relevant sections applicable to you! when an amendment is made in the original return.ġ19(2)(b): When return is filed in response to notice received from the Income Tax Department under the said section. when return is voluntarily filed after the due date.ġ39(5): Revised Return i.e.

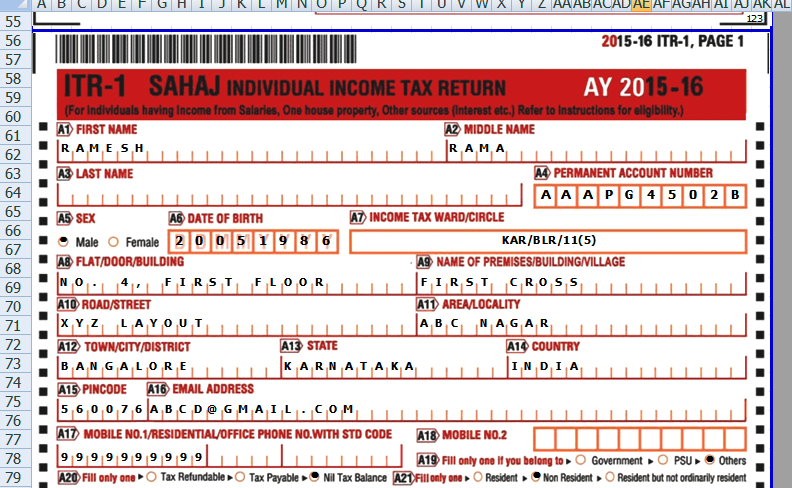

These are :ġ39(1): When return is filed voluntarily on or before the due date.ġ39(4): Belated Return i.e. There are various sections under which return is filed. Section 142(1) - Assessment or Reassessment Notice U/s 148.Section 139(9) - Notice for defective return.Select the applicable option, depending on whether the return filed is under section This would be used by the IT department for all communications. (b) You are of eighty years or more at any time during the F.Y.Įnter your Date of Birth as per your PAN card in DD/MM/YYYY formatĮnter your valid mobile number, this would be used by the IT department for all communications.Įnter your current full address.

(a) You are living in the States of Assam, Jammu and Kashmir and Meghalaya.

Incase, you fall in the below mentioned category then filling of your aadhaar no is not mandatory : Enter your 12 digit Aadhaar Number or 28 digit Aadhaar Enrolment ID in case you do not have your Aadhar with you.

Providing Aadhaar Number is now mandatory while filing returns. Enter your full name as per your PAN Card

0 kommentar(er)

0 kommentar(er)